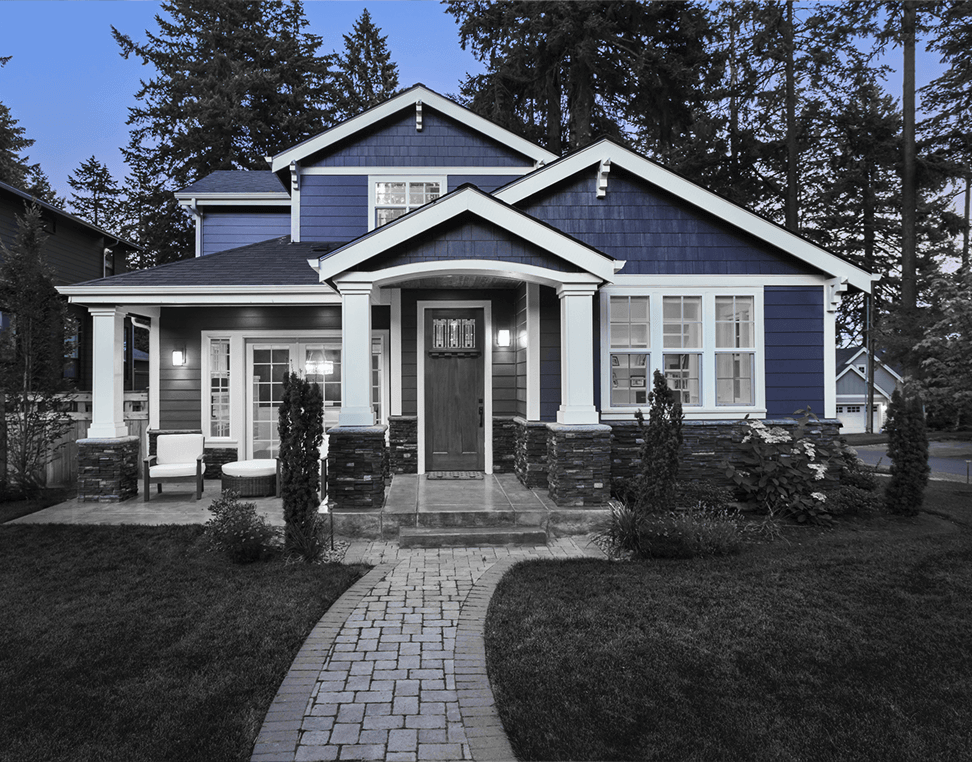

Guidance for one of life's biggest financial decisions.

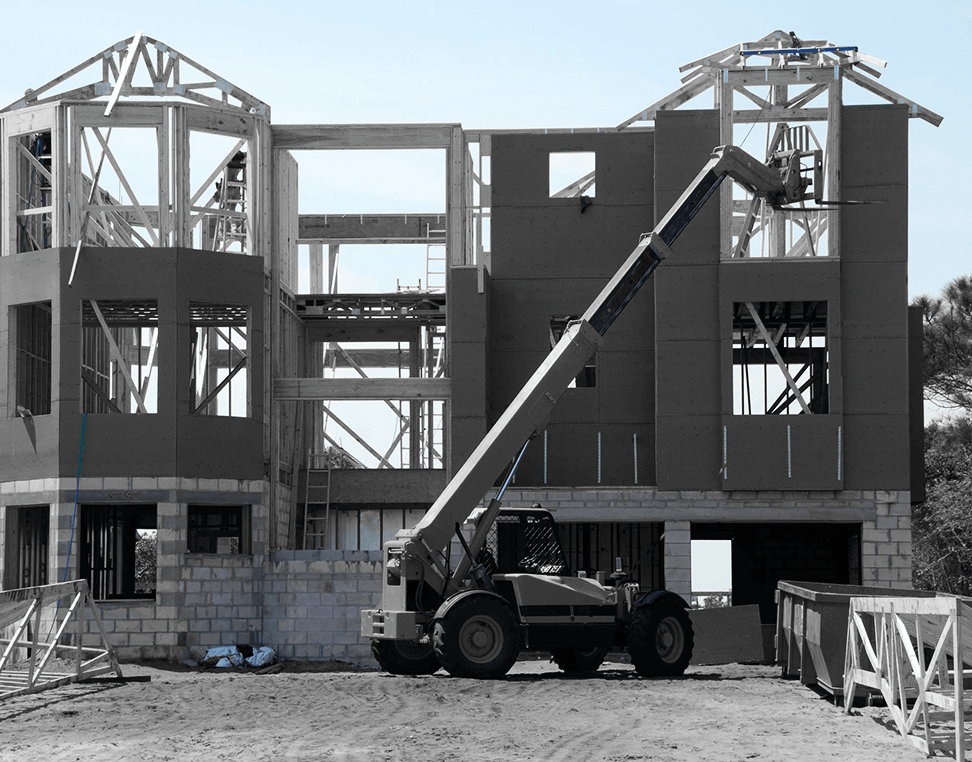

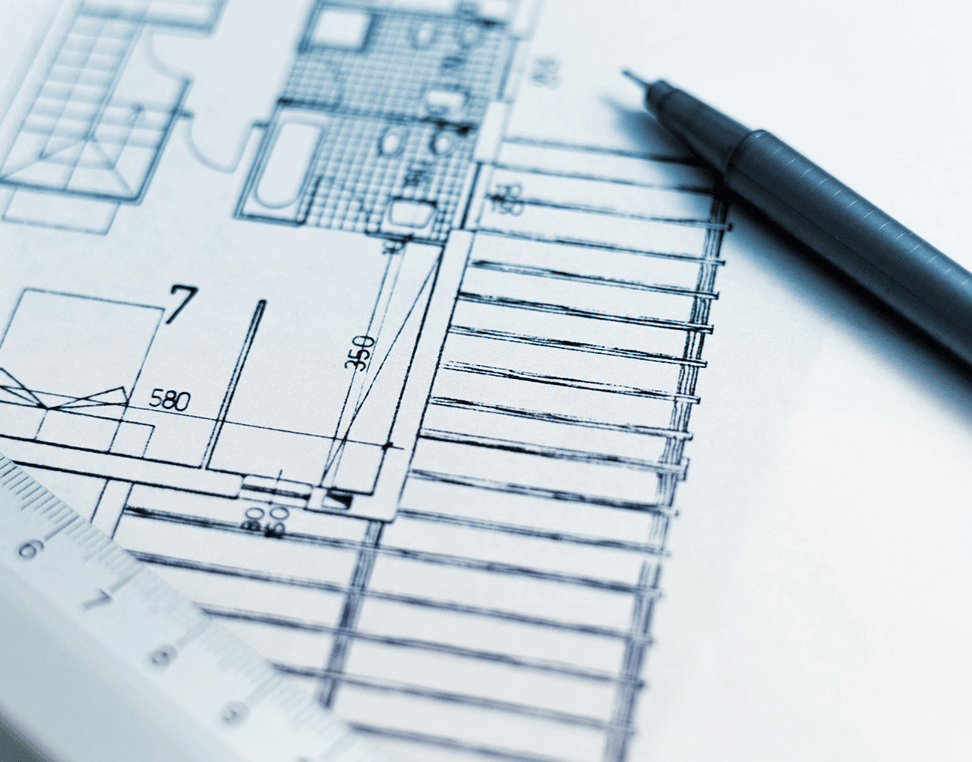

Financing a home does not have to be complicated. The mortgage experts at FNB can help you navigate options to choose the best financing solution for you.

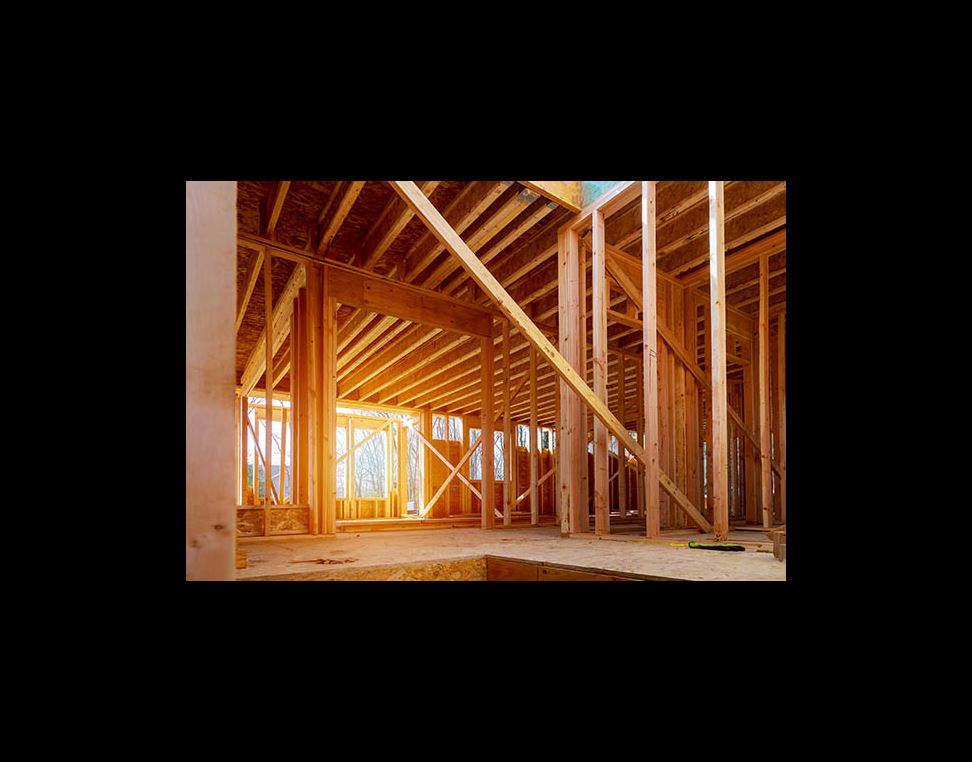

Whether you’re looking to buy, refinance, build or fix up a home, we have a mortgage that can help you achieve your dreams. Click on a box to learn more or click Get Started to begin your journey.

At FNB, we offer a wide range of products to help you buy your first home. From home loans with little or no down payment requirement, to government programs designed for first-time homebuyers. Some applicants may even qualify for closing cost assistance.

Learn More >We’ve been helping our neighbors become homeowners for more than 150 years. As part of our ongoing commitment to the communities we serve, we have expanded our offerings to encourage homeownership and financial independence — especially in historically underserved communities.

Learn More >FNB Home Ownership Plus is a new mortgage loan designed to mitigate common financial barriers to homebuying in diverse communities. FNB’s Home Equity Plus program enables consumers to finance improvements to their homes.

Learn More >Strengthening our communities by supporting affordable homeownership. Learn more.

Most physicians have unique banking needs. That’s why we developed a mortgage program especially for you.

Play Video

Financing a home is one of the biggest financial decisions you will make in your lifetime. Whether you are buying a home, refinancing an existing home, building the home of your dreams or renovating a home into something special, you need a bank with trusted mortgage professionals who can provide the options you need and the service you deserve.

Tell us about yourself so we can find the loan option best suited for you.

If buying a home, shop confidently and know what you can afford.

Submit documents to help us verify the information you provided.

We will review your application and let you know if additional information is needed.

Underwriters will review your application for program eligibility.

Upon receipt of conditional underwriting approval, please provide requested documents quickly.

Review your Closing Disclosure containing the final approval details of your loan.

Review and sign the final paperwork for your loan.

Determine how much you can afford to borrow.

Calculate the difference between a higher and lower down payment.

Calculate whether a fixed or adjustable rate works best.

Calculate the affordability of a new home loan.

Calculate the changes a new loan will have on your monthly payment.

Figure out much money you'll need to purchase your dream home.

Building your first home is a significant financial decision. While you may be excited to begin looking for the ideal property and.

A packed schedule leaves little time to research home building and financing options. Consider the following steps to simplify pro.

As a physician, your busy schedule may leave scant time to research home building and financing options. Specialized financing pro.

Proceed to Checkout

© Copyright 2024 F.N.B. Corporation. All Rights Reserved.

One North Shore Center - Pittsburgh, PA 15212

(Click here for address for service of all legal documents)

1-800-555-5455

Bank deposit products and services provided by First National Bank of Pennsylvania. Member FDIC.

Investment and insurance products are not insured by the FDIC or any other federal government agency, are not deposits or financial obligations of the financial institution, are not guaranteed by the financial institution and they do involve investment risk, including possible loss of principal.

Not all products and services are available in all geographic locations. Your eligibility for particular products and services is subject to final determination by F.N.B. Corporation or its affiliates and acceptance.